Cost Plus Markup Math

This is probably the most common scenario you know how much you paid for something and your desired markup and therefore want to find the sale price.

Cost plus markup math. Markup gross profit cost. So the markup formula becomes. The ratio of your profit 25 to your cost 75 is 33 33. How to compute fixed markups.

Dollar markup value is the addon factored amount expressed in actual dollars. Learn more in cfi s financial analysis fundamentals course. The formula for calculating markup percentage can be expressed as. Fill in what we know.

Wholesale cost price is the cost to buy the product by you including your overhead cost percentage. Cost plus pricing ensures that prices are high enough to meet profit goals. Markup 4 50 2 50 2 50. Markup 2 2 50.

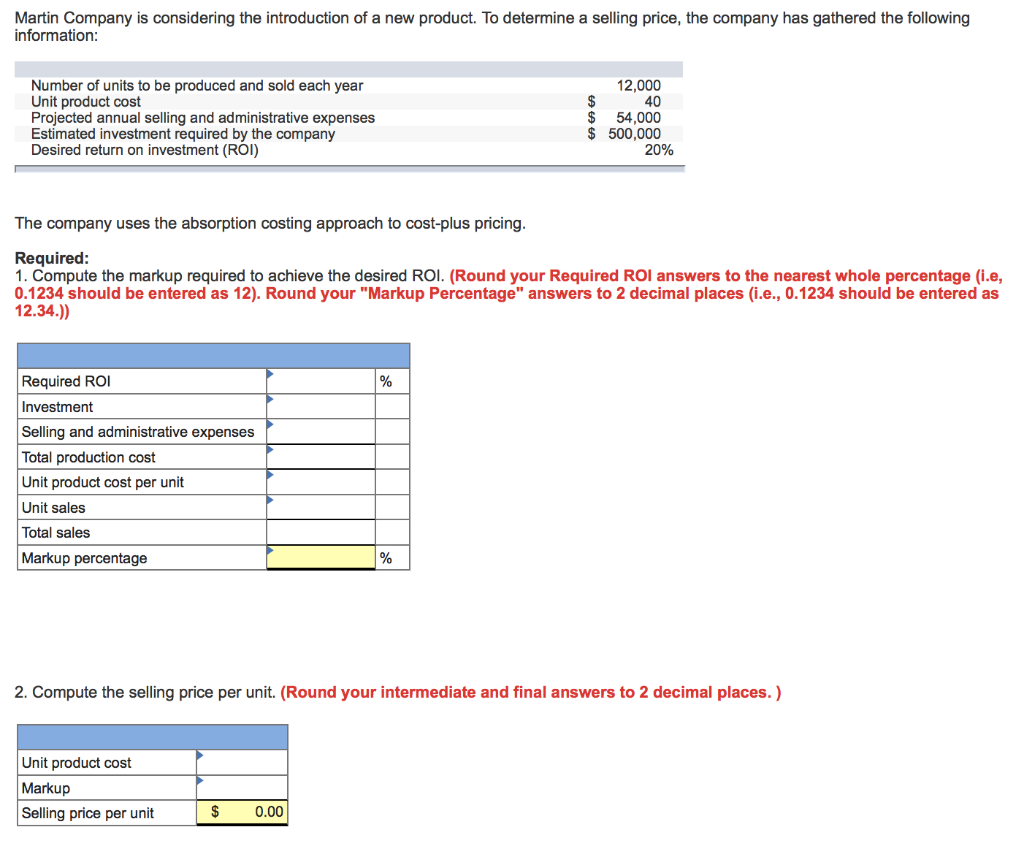

Many retailers and manufacturers set their prices at cost plus by adding a fixed markup to their absorption cost. Markup refers to the ratio of cost to profit and it s expressed as a percentage value. Markup 100 revenue cost cost. Profit refers to the difference between cost and revenue.

Start with the formula. The figure illustrates how cost plus pricing computes the sales price by adding markup to a product s fixed and variable costs. And finally if you need the selling price then try revenue cost cost markup 100. For example if a product costs 10 and the selling price is 15 the markup percentage would be 15 10 10 0 50 x 100 50.

For instance if you purchase an item for 50 then you sell the same item for 75 this gives you a profit of 25.