Compounded Continuously Financial Calculator Math

Where r is your stated interest rate.

Compounded continuously financial calculator math. Compound interest calculator calculate compound interest step by step. If it took 6 years for your initial amount compounded continuously at an interest rate of 4 and you ended up with 11 44 then your initial principal was 9. This formula makes use of the mathemetical constant e. Calculate rate of interest in decimal solve for r.

After 4 years your original 9 compounded every 3 months will become a final amount of 9 44. Compound interest formulas and calculations. Each new topic we learn has symbols and problems we have never seen. To calculate the ending balance after 2 years with continuous compounding the equation would be.

A p e r t 11 44 p e 0 04 6 11 44 p e 0 24 11 44 e 0 24 p 9 p. Compound interest calculator compound interest is calculated on the initial payment and also on the interest of previous periods. Calculate accrued amount principal interest a p 1 r n nt. In the formula a represents the final amount in the account that starts with an initial principal p using interest rate r for t years.

The continuous compounding calculation formula is as follows. Simple interest compound interest present value future value. R interest rate. R r 100.

Math can be an intimidating subject. To calculate continuously compounded interest use the formula below. Fv future value. This can be shown as 1000 times e 2 which will return a balance of 1221 40 after the two years.

For comparison an account that is compounded monthly will return a balance of 1220 39 after the two years. R n a p 1 nt 1 calculate rate of interest in percent. A p 1 r n n t r 1 2 100 0 012. Pv present value.

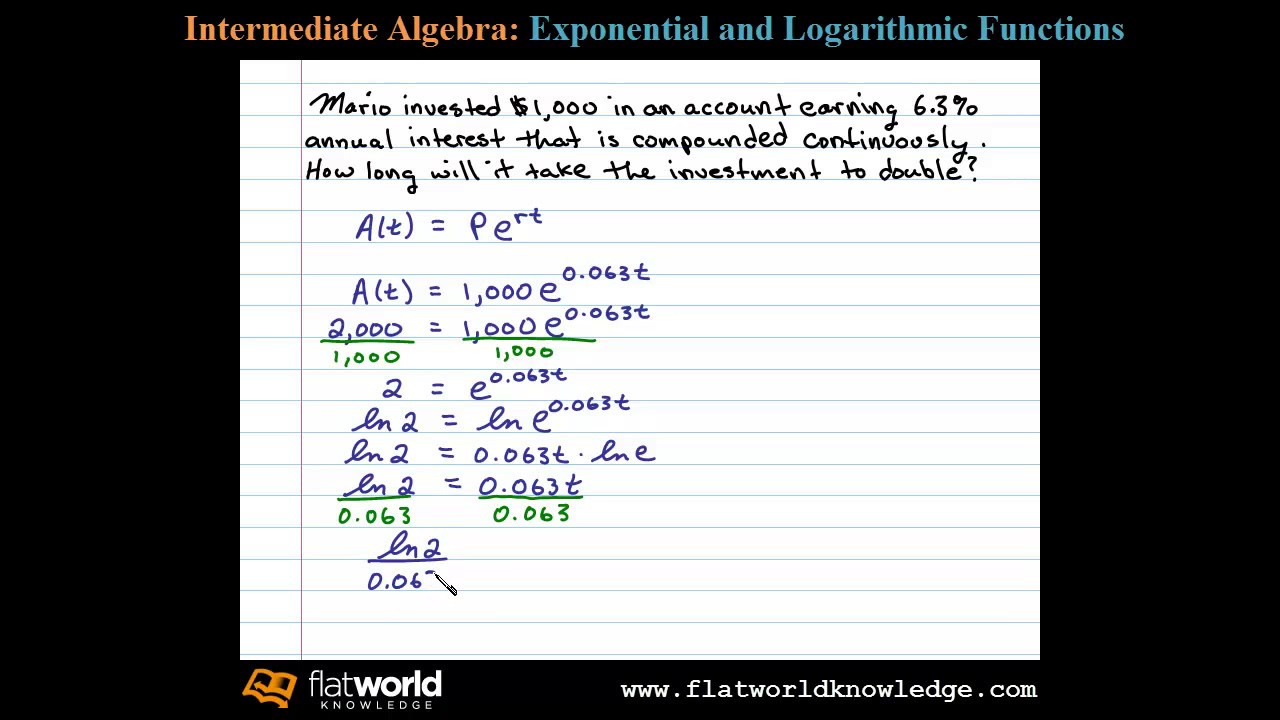

Now let s see how we can solve continuous compounding problems on our financial calculator. Worksheet 1 on continuously compounded interest no logs worksheet 2 requires use of logs compound interest formula. This formula for finding the future value of an initial investment that is continuously compounded can be manipulated to yield the following formula that we can use for calculating the effective interest rate. Fv pv e rt.

P a 1 r n nt. Suppose you give 100 to a bank which pays you 10 compound interest at the end of every year. A p e r t r 4 100 0 04. T number of time periods.

Calculate principal amount solve for p.